How Do I Find…

- Public Comment for Part B of the Individuals with Disabilities Education Act (IDEA) Federal Fiscal Year 2024 (State Fiscal Year 2025)

- Public Meetings

- Reports & Data

- Standards & Instruction

- Federal Relief Funds (ESSER)

- Special Education Dispute Resolution

- NDLC (Nevada Digital Learning Collaborative)

- NV State Improvement Plan (STIP)

- Professional Learning

From NDE

- 4/22/2024 Nevada Department of Education Announces 14 Purple Star Schools

- 4/18/2024 - Nevada Department of Education Hosts Inaugural Nevada Reading Week Librarian Conference

- 4/12/2024 - Henderson Special Education Teacher Receives Milken Educator Award

- 4/3/2024 - Nevada Department of Education Holds Town Hall Meetings about Artificial Intelligence

- 3/27/2024 - Las Vegas School Registrar Among Five Finalists for National Award

- 3/20/2024 - Nevada Department of Education Director Amber Reid Honored with State Leadership Award

- 3/15/2024 - Nevada Department of Education Issues Notice of Individuals with Disabilities Education Act (IDEA) Annual State Application

Inside NDE

Mission Statement

Our mission is to improve student achievement and educator effectiveness by ensuring opportunities, facilitating learning, and promoting excellence.

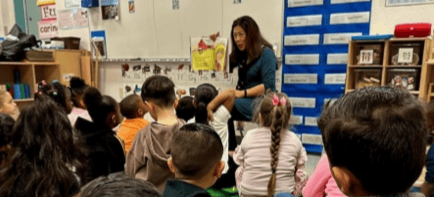

Celebrating & Supporting Current and Future Educators

The mission of the Nevada Teacher of the Year program is to celebrate excellence and strengthen the teaching force by honoring and recognizing exceptional teachers on a school, district, state, and national level

Transparency & Reliability

Districts, schools, and communities are served through efficient and effective use of public funds and fulfillment of statutory responsibilities.